GnuCash is a single-user system, so you won’t be able to network the product to accommodate additional users. But if you plan on being the only user, you can download this small business accounting application anytime at no cost. If you’re not entirely comfortable using a software application, Sage Business Cloud Accounting is designed for you. A good fit for sole proprietors, Sage Business Cloud Accounting makes it easy to track inventory sales and services. Even if you’re a sole proprietor, it’s a good idea to open a business bank account. Under the conservatism concept, revenue and expenses are treated differently.

- The Alliance for Responsible Professional Licensing (ARPL) was formed in August 2019 in response to a series of state deregulatory proposals making the requirements to become a CPA more lenient.

- This isn’t just memorizing some accounting information for a test and then forgetting it two days later.

- As an OpenStax book, it has gone through QA procedures and reviews and it also appears to me to be accurate and error-free.

- Automation tools save businesses and accountants time by limiting the amount of time they spend on data entry.

- The table below presents IBM’s fourth-quarter earnings report from 2016.

- These critics claim having strict rules means that companies must spend an unfair amount of their resources to comply with industry standards.

It makes it easier for stakeholders to understand and compare performance because it separates it into short periods of time. It also makes it easier for them to see the most current financial information. All financial information, both negative and positive, is disclosed accurately. The proper reporting of financial data should be conducted with no expectation of performance compensation. This is a promise from the accountant that they‘re not trying to mislead anyone. This helps investors trust that the information your business presents is accurate.

Overview: What is small business accounting?

Under this assumption, revenue and expense recognition may be deferred to a future period, when the company is still operating. Otherwise, all expense recognition in particular would be accelerated into the current period. This concept is not usually a major concern – only when a business is getting close to being insolvent. Under the economic entity concept, the transactions of a business are to be kept separate from those of its owners.

It needs to be explain now even though the tools are evolving quickly to be cloud based and app based. Generally Accepted Accounting Principles are important because they set the rules for reporting and bookkeeping. These rules, often called the GAAP framework, maintain consistency in financial reporting from company to company across all industries. Materiality Concept – anything that would change a financial statement user’s mind or decision about the company should be recorded or noted in the financial statements. If a business event occurred that is so insignificant that an investor or creditor wouldn’t care about it, the event need not be recorded. This prevents companies from hiding material facts about accounting practices or known contingencies in the future.

Certified Public Accountant

The text covers all the important aspects that should be covered in the introduction to financial accounting. The text covers an overview of accounting information systems which I have not seen in textbooks I’ve used. Principles of Accounting Volume 1 is mostly an outline of accounting rules that have been around for a long time; won’t change; and will be relevant for the foreseeable future. There are some changes (e.g. analytics) that changing the way accountants work. The text does have material in Chapter 7 (e.g. 7.1 storing data) that may need to be addressed as technology changes and/or might make it obsolete, but I don’t see a way around this.

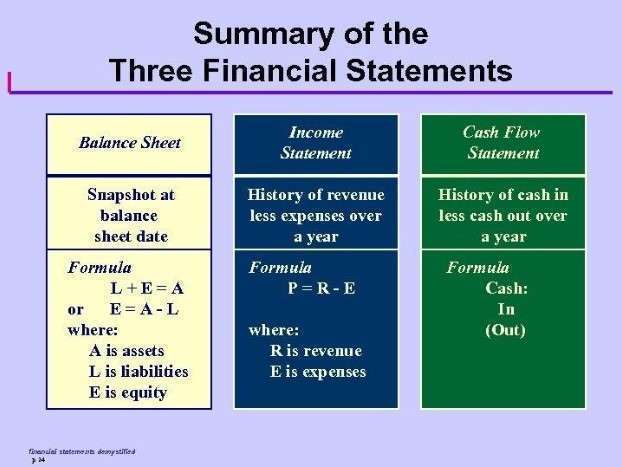

Some of the basic accounting terms that you will learn include revenues, expenses, assets, liabilities, income statement, balance sheet, and statement of cash flows. You will become familiar with accounting debits and credits as we show you how to record transactions. You will accounting basica also see why two basic accounting principles, the revenue recognition principle and the matching principle, assure that a company’s income statement reports a company’s profitability. This is the practice of recording and reporting financial transactions and cash flows.

Additional Accounting Topics

Revenue Recognition Principle – requires companies to record revenue when it is earned instead of when it is collected. This accrual basis of accounting gives a more accurate picture of financial events during the period. Historical Cost Principle – requires companies to record the purchase of goods, services, or capital assets at the price they paid for them. Assets are then remain on the balance sheet at their historical without being adjusted for fluctuations in market value. When all of your transactions have been entered, you’re ready to run your financial statements. Start with an unadjusted trial balance, which can help locate any out-of-balance accounts.

Accounting Principles: Basic Definitions, Why They’re Important – NerdWallet

Accounting Principles: Basic Definitions, Why They’re Important.

Posted: Thu, 06 Jul 2023 07:00:00 GMT [source]

It’s also a good idea to set your fiscal year when you start your business. The working accountant is compliant with GAAP rules and regulations. While math skills are helpful, data and systems analysis are keys to success in this role. This means that curiosity and deductive reasoning skills are also useful. You should have safe channels for transferring these documents so the data is safe from bad actors. The straw-like fibers that create the grain structure in the lumber, run the length of each piece of lumber.

Business Forms

This explanation of accounting basics will introduce you to some basic accounting principles, accounting concepts, and accounting terminology. Having a separate bank account for your business income and expenses will make your accounting easier. You’ll only have one account to monitor for bookkeeping and tax purposes, and your personal income and expenses won’t get entangled with your business ones. Believe me — only having to look at one set of bank statements is a lifesaver during tax season. A cash flow statement analyzes your business’s operating, financing, and investing activities to show how and where you’re receiving and spending money.

Leave A Comment